Well, it’s been nine months since we paid off our last debt. (Which was the US Department of Education – my student loans. Not sure if I ever told you that!)

It certainly has been nine months of living like no one else, in more ways than one. I know so many of you are fighting the good fight against your own debt, and I wanted to follow up on our story and continue to give you the motivation to KEEP GOING.

It is so incredibly, amazingly worth it.

Many of you have asked what made us decide to finally attack our debt. (Which was $125,000. Yes. Three zeros. Six digits.)

I try to be as transparent as possible on this blog, especially when it comes to our debt story. But money is probably one of the most sensitive of topics, so I try to walk the line of what to share and what not to share.

I’ll tell you we were sick and tired of making a decent living and having absolutely NOTHING to show for it but wallets full of credit cards. It was just ridiculous and sad and depressing. Month after month, half of our money went to a credit card. Or a student loan. Or a car payment.

We had money leftover, but not a ton. So when we wanted something and couldn’t afford it – what did we do? Charge it.

It wasn’t crazy or extravagant. It was just little bits, here and there. It was breaking one of my own golden rules:

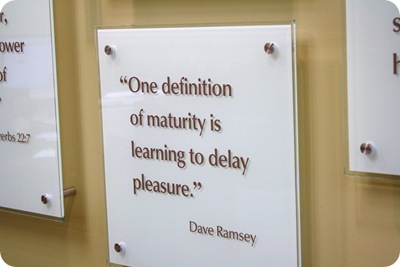

I had first heard that quote in college and it stuck with me. I would recite it to myself often. Obviously not often enough. ;)

And one day, something clicked. We finally got serious about changing our lives.

Because we got MAD. Madder than hell.

We wanted to keep our money. We worked hard for it (who doesn’t?) and dang it, we were finally spitting mad about passing it out to them and them and THEM and them every month.

That’s what it takes to make it happen. You need to get ANGRY at the debt. You need to want it out of your life so bad it’s all you think about, dream about, focus on. GET FURIOUS.

So we got mad. :) And we attacked it.

I’ve mentioned before we didn’t follow the “plan” to a T – we didn’t always go after the smallest debt first. We had some credit cards with just insanely high interest rates, so we went after those first.

We didn’t eat rice and beans. Well…sometimes at the Mexican restaurant. ;) We did still eat out and treat ourselves occasionally.

But we did follow the Dave Ramsey plan otherwise. No, it’s not rocket science. Ramsey himself will tell you that. But when you’re drowning in debt (and when you finally take the time to add it all up and realize how much you are drowning), you feel completely hopeless.

I’ve had a few really sucky days in my 36 years and the day we added it all up was one of the worst.

Dave Ramsey gives you the HOPE. He gets you amped UP. Crazy intense.

(When I took this picture I was as giddy as a grown woman teenage girl waiting to meet NKOTB. I went to take Dave’s picture and right when I took this he waved. AT ME!!! I was all bouncy and hyper and texting all my girlfriends. For reals.)

It felt like we’d never get there…we worked at it for years. When we were getting to where we could feel the finish line, we decided to take Financial Peace University at our church.

I have to tell you – that class was one of the most amazing experiences we’ve ever had. It bonded my husband and I and made us even more excited and determined. There were moments when my husband would reach out and squeeze my hand and we were SO in this together.

This process changed our lives and it changed our marriage.

We finished paying off our debt two months after our last class. The 125,000 pound monkey was off our backs and it was surreal.

(This couple was there the day I met Dave – I had to take their picture because they had paid off something like $400,000. Talk about inspiring and emotional!)

It took a while for it to sink in. There are still moments when I realize we don’t have car payments. How stinkin’ weird is THAT?!

And yes…we’ve been able to do some things we would have never done before. Well – we may have done them. But we would’ve been paying them off for the next five years.

Let me tell you – sitting out on our patio at night sure is sweeter when it’s completely paid for and all ours. :)

But I think it’s important to mention all the ways we live like no one else – just in ways you wouldn’t think.

Our paid for cars aren’t fancy – not at all. Hubby’s car is nine years old with something like 210,000 miles on it. Mine is seven years old with 110,000 on it with a stupid amount of dings and dents. (I’m a magnet.)

We NEVER go on vacation. We go on some fantastic trips but they are ALL for hubby’s work. Always. Our last three trips to NYC have been business-related. Even our RV vacation this past summer was planned because of a work commitment – I don’t know if we would have done it otherwise. (Now that we have, we’re doing it again next year for sure!) Other than a few weekends to New York here and there, I don’t think in all the years I’ve been with my husband we’ve gone on one vacation together.

I hardly ever get my hair cut, nails done, new clothes. I got my nails done yesterday and I think the last time I did that was about the time we paid off our debt. ;)

I use a box to color my hair (completely necessary –- the greys are out of control), my hubby doesn’t treat himself EVER (I try to get him to, but he just doesn’t), and we don’t buy name brand…well, of pretty much anything.

But saying it’s all worth it is a complete understatement. We have started a new course for our marriage and our kids and our family tree.

When you’re considering giving up the cards, paying off your debt or are in the middle of it – you NEED to hear that it can happen. And you need to hear that’s it’s as peaceful as you think it is.

It is. All of the above. :)

One evening while in our Financial Peace class I turned to hubby and told him I needed to help someone else get there that wanted or needed to be there. (It was that powerful.)

I approached my new friends at Financial Peace Plaza and they agreed to help me out. ;) I’m paying it forward and want to provide some of you with the chance to go through the class. I’m giving away three Financial Peace packets and the wonderful folks with Dave Ramsey are throwing in two more of them.

You will get everything you’ll need in a box – and if you are able to attend the class, I WANT YOU TO GO. Sorry I’m yelling. :) The class is so worthwhile. (Go here to find one near you. I’ll either have the packet sent to you or pay for it through the church where you’ll attend – just let me know.)

If you don’t have a class nearby, you can go through it with the info and CDs in the packet. Either way, we want to help five (individuals or couples) kick start your own peace.

I also have three new copies of the Total Money Makeover book – it’s the one that we got hooked on and it’s the one they recommend to anyone thinking about taking the plunge.

Because debt is a private issue, I’m not going to ask you to leave a comment here to “win.” ;) If you’d like a chance to attend Financial Peace free of charge, or if you’d like a copy of the book, just send me a quick email. I don’t need anything else from you other than a brief hello. (thriftydecorchick at gmail dot com)

Title it “DEBT FREE!” and just let me know if you’re interested in Financial Peace or the book. That’s it. I hate to put a deadline on something like this, but I want to get you going as soon as possible if you win, so let’s say I’ll take emails till next Thursday, the 17th.

Thanks again for your support and love throughout our journey – it has meant the world to us. Your encouragement and celebration made the process even more worthwhile. :)

**You can learn more about our debt story here. And read how awesome it is to be weird here.

**All pics are from last winter when I visited FPP with a bunch of bloggers. We had a blast!!

No comments:

Post a Comment